The student loan bubble is starting to burst.

Young adults are taking record levels of student loans and other debt to earn bachelor and associate degrees.

Beginning in 1958, President Dwight Eisenhower federally subsidized increased levels of student loans for millions of young Americans struggling to afford higher levels of education through the creation of the Free Application for Federal Student Aid. Many advocates of higher education applauded Eisenhower’s monumental step to create opportunities for millions of Americans who were struggling to attend college because of the financial burden.

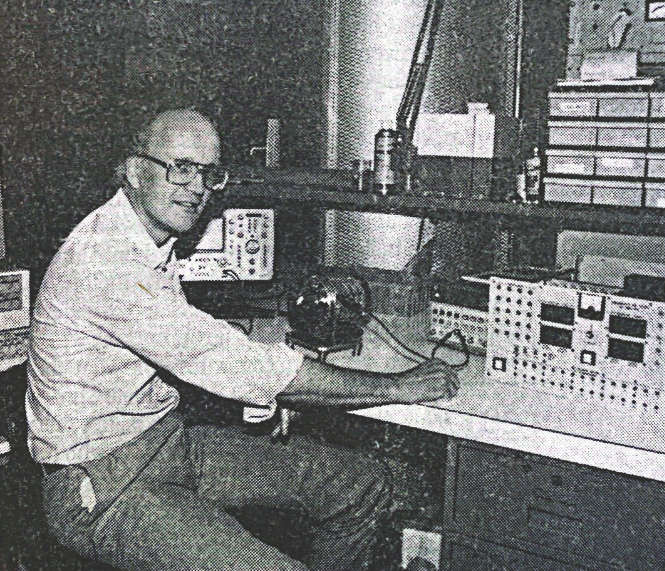

Daniel Arce, an economics professor, noted the decreased availability and affordability of student loans from when he attended college in comparison to now.

“When my wife and I graduated college many years ago as Ph.D recipients, we were completely debt free,” Arce said. “If I had to make the same decision as a college undergraduate now, the decision may take considerable deliberation.”

However, loans are gradually becoming less accessible for college students each year as they must shoulder the responsibility of paying upwards of $65,817 in debt on average, according to the FAFSA. If the tuition and cost of resources required for college increase due to the increasing population of the United States, the average college debt rate will only increase in the near-future.

Kyle Jackson, an economics graduate student, expressed his outrage towards the willingness of students to take sizable loans.

“After years of watching students struggle with their loans, sometimes I wonder why students even go to college if they only choose career paths that offer no feasible way of paying them back,” Jackson said.

While 30 percent of the student body at UTD takes on an average $5,969 in loans, according to the UTD financial aid department, 60 percent of U.S. college students must annually borrow more in order to cover the overall costs of college according to American Student Assistance, a student financial aid research organization. Jimmy Solice, a current undergraduate student, has even exclaimed his concern towards the rising interest rates of student loans.

“I really fail to see the purpose in attending college when I lose more money each year than I would make each year after I graduate,” he said.

While the increasing interest rates of student loans are having major financial effects on students, local governments that are responsible for subsidizing college education are also experiencing the detrimental effects of the growing debt bubble.

Tom Harkin, the chairman of the Health, Education, Labor and Pensions Committee that leads federal initiatives pertaining to student aid, has issued a statement directly to local governments in Texas.

He said they need to be held accountable for the federal student aid they distribute because thousands of students each year cannot meet their financial obligations. They default on a debt burden they are incapable of meeting. Arce expressed his concern for students taking sizable student loans without considering the prospect of paying off their debt with their respective majors.

“You need to take into account your major when you’re taking out student loans,” Arce said. “But it’s important to see how the salaries will be in the future.”

In light of the overwhelming consensus among students and educators concerning the detrimental economic effects of the debt crisis, several financial and political institutions have taken effective steps toward mitigating the crisis through a variety of approaches.

Many financial aid research institutes have taken initiatives to educate students, through interactive websites, such as asa.org, which offers various financing options, comparative breakdowns of student loan rates and documents the increase of interest rates throughout history.

Additionally, many web organizations, such as the Project on Student Debt, offer material that can be integrated into any high school curricula to make sure students are informed about the various financing alternatives to loans and how much students should approximately borrow without becoming victims to overwhelming debt.

While educational resources informing students of the economic risks of taking excessive loans are becoming more available through online web organizations, students must collectively take the initiative to examine the consequences of their own financial decisions before entering college.