Price increases are linked to renovations, utility inflation, existing debt and general trends in the real estate market.

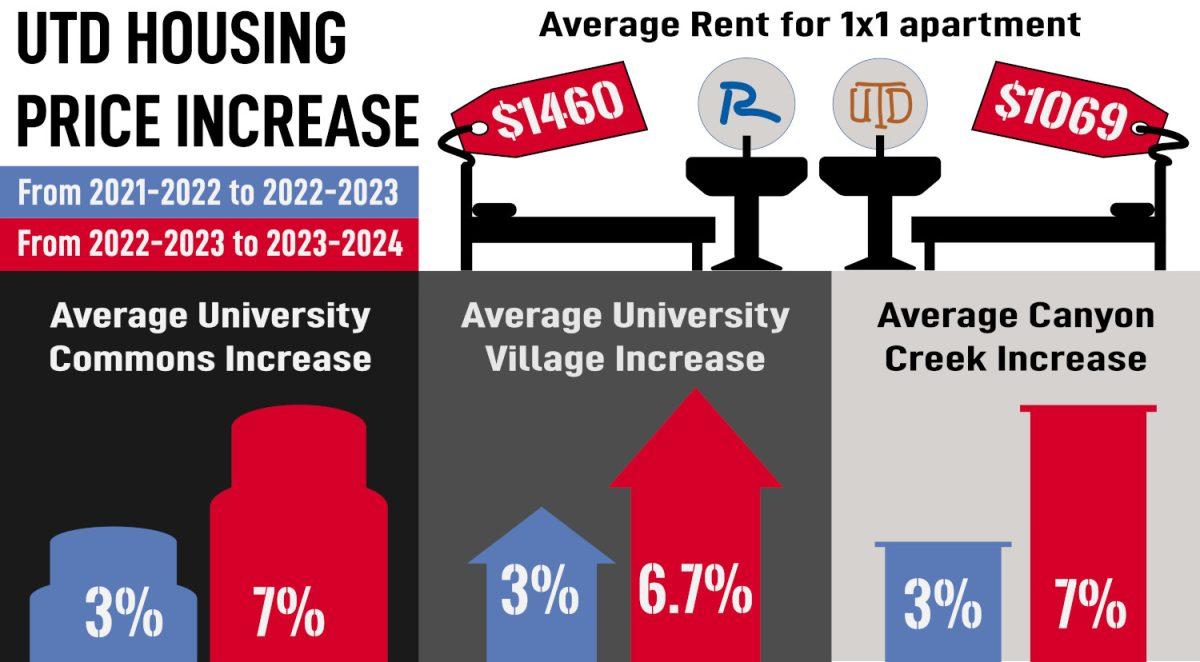

Going into 2023-24, University Housing prices increased at a cumulative average of 6.9%, compared to 3.2% in the prior year. 1×1 floor plans are still the most expensive, but also saw a much larger jump in price compared to last year. In an interview with The Mercury, Matthew Grief, associate vice president of Student Affairs, explained the reasons behind these price increases. A majority of the increase will cover the rising price of utilities, unknown salary and benefit increases for employees and emergency repairs on older housing. Historically, other increases have been used for funding planned renovations and improvements, paying off existing debt and filling Housing’s money reserves.

“Our budgets are built off financial pro-formas that we utilize to track revenue, expenses, debt service and plans for future housing and projects,” Grief said in an email statement. “Typically, we have stayed in the range of 3 to 4% to plan for projects, for a facility’s unknown needs, along with similar planned expenses outlined above.”

Orkun Toros, the assistant vice president for the Office of Budget and Finance, said in an email statement that departments like Housing are required to hold “set asides” — or money reserves — to ensure their sustainability. These reserves were especially impacted in 2020 by the pandemic.

“Our financial reviews have shown that COVID hit the self-supporting units, such as Housing, very hard with lost revenues and refunds … Most units have depleted or have been trying to recover to their historical set aside amounts,” Toros said.

Grief said that during COVID, UTD refunded several million dollars of housing expenses to students, and in 2021, there was no rent increase. During the rent freeze, Housing still had to cover its operating costs.

“We increased 3% last year, and even that 3% last year is probably not going to cover our increases that we’re seeing this year right now, just because of unknowns,” Grief said.

Julie Lynch, director of the Herbert D. Weitzman Institute for Real Estate and associate professor of practice, said that the pandemic motivated individuals to seek out new housing, in part from a need for home office space. In July 2020, the U.S. saw its highest mortgage lending ever recorded, due to people both refinancing their homes and buying new homes. However, supply chain issues slowed housing build time, and the corresponding demand increased prices.

“Now [the shortage] has pretty much corrected itself. But at the end of the day, home prices or values of properties in [2021] and [2022] increased as much as 20% a year … And your real estate taxes are tied to the assessed values of the properties. So as the property prices go up, so do the real estate taxes. And so although you are paying rent, part of what you’re compensating back the landlord for is to cover their cost of the real estate taxes.”

Grief said that housing examines both local rents and other UT schools’ prices when deciding on increases. Assuming 9 months of occupancy in an academic year, 1×1 residents can expect to pay about $1069 per month in 2023-24, which includes utilities. This is approximately 27% below the average rent for a 1×1 apartment in Richardson, which, according to a zumper.com average calculated from local internet listings, sits at $1460 per month as of April 2023.

“Our rates have consistently been lower than comparable facilities in the areas around UTD, and in some cases 50-70% below their costs,” Grief said in an email statement.

Between 2022-23 and 2023-24, the average 1×1 floor plan increased 8.8% in price, compared to a 3% increase from 2021-22 to 2022-23. This is in contrast to 4×2 floor plans, which saw an increase of only 3.2% moving into next year, compared to a similar 3% in the year prior. Grief said that in recent years, one-bedroom units — which require more full-unit repairs when a student moves out — have seen higher turn-over rates.

“Whether that means replacing the carpet, repainting the entire apartment, those costs kind of add up,” Grief said. “So we’re seeing an increase there, and we kind of have to offset that. And we also know that we want to provide an affordable product for our students, but we know that we are well behind with the market shares. And I know that sounds harsh, but we have to kind of catch up.”

Moving into 2023-24, floor plan prices increased at a cumulative average of 6.9%, compared to the respective jump last year, which was only 3%. Zumper.com estimated that Richardson rents had decreased 3% between 2022 and 2023.

Part of next year’s rent increase plans to accommodate inflation in utility prices, including electricity and the gas that powers Housing’s hot water boilers. Last year, University Housing spent about $3.9 million on utilities and expects to spend about $4.3 million on utilities this year.

“This year alone we anticipate a $500,000 budgetary impact (increase) for UTD housing utilities,” Grief said.

Lynch said that local rent inflation in the past few years can be attributed both to utility inflation as well as a general trend toward limited housing supply, higher home values and higher real estate taxes.

“Now, we have record inflation in 40 years, and utility prices, and particularly electric, increased double digits also during that time frame,” Lynch said. “So, depending on the rent structure, if your electric is included in your rent, your rent is gonna go up.”

Grief said that price increases also take into account future renovations and improvements to housing. A package locker system has recently been installed and should be operational next fall, following a testing period in the summer. Other renovations will be done during the summer, including new plank-style flooring and carpet tiles, which are easier to replace.

Renovations and improvements for this academic year were conducted during summer 2022, including fully replacing 188 units of carpet as well as over 1,000 bedroom unit carpets. Housing also repainted about 500 units partially and 37 units in full. Grief said that the largest project of the summer was the replacement of air conditioning units, which has been in progress for three years.

Grief said that Housing holds reserves of money in order to demonstrate UTD’s financial health and allow for future planning. Those reserves are meant to meet a debt-service ratio of about 1.30, which represents Housing’s ability to generate enough money to cover its debt obligations. According to Grief, Housing typically holds about $17 million dollars in debt in a year.

“Because when we build a new housing project … Even with the revenue from the students, [it’s] not gonna pay for itself,” Grief said. “So we as a university have to show that we can afford that.”

Lynch said that North Texas finds itself in a unique economic environment due to the intersection of several “opposing forces.” These include record low unemployment and record high income in Dallas but also inflated interest rates and an increase in expenses.

“So in real time, everybody’s asking the same question you are, and they’re looking at on-demand economic indicators to navigate and read the economic environment,” Lynch said. “So everybody wants to know the answer to that question, but based on my predictions, I think rents will start to flatten if we can get inflation under control.”

Grief said that maintaining reserves is important for UTD to show its financial strength for future development. However, Housing has not announced any concrete plans for new development since April. According to Facilities and Economic Development’s website, between 2011 and 2014, UTD completed a new residence hall every year. Since 2018, the only housing UTD has built are new phases of Northside apartments, which are the most expensive option for students. Next year, 1×1 units at Northside run at $1500 or more.

“We’re gonna build in the near future, and when we build, we’re gonna have to show that we can support it. And that’s what that reserve does,” Grief said.