Residents of University Village Phases 1-3 and Canyon Creek Heights will be able to vote in a Richardson Independent School District tax ratification election to raise taxes for higher teacher salaries and larger staffs for special education and school security.

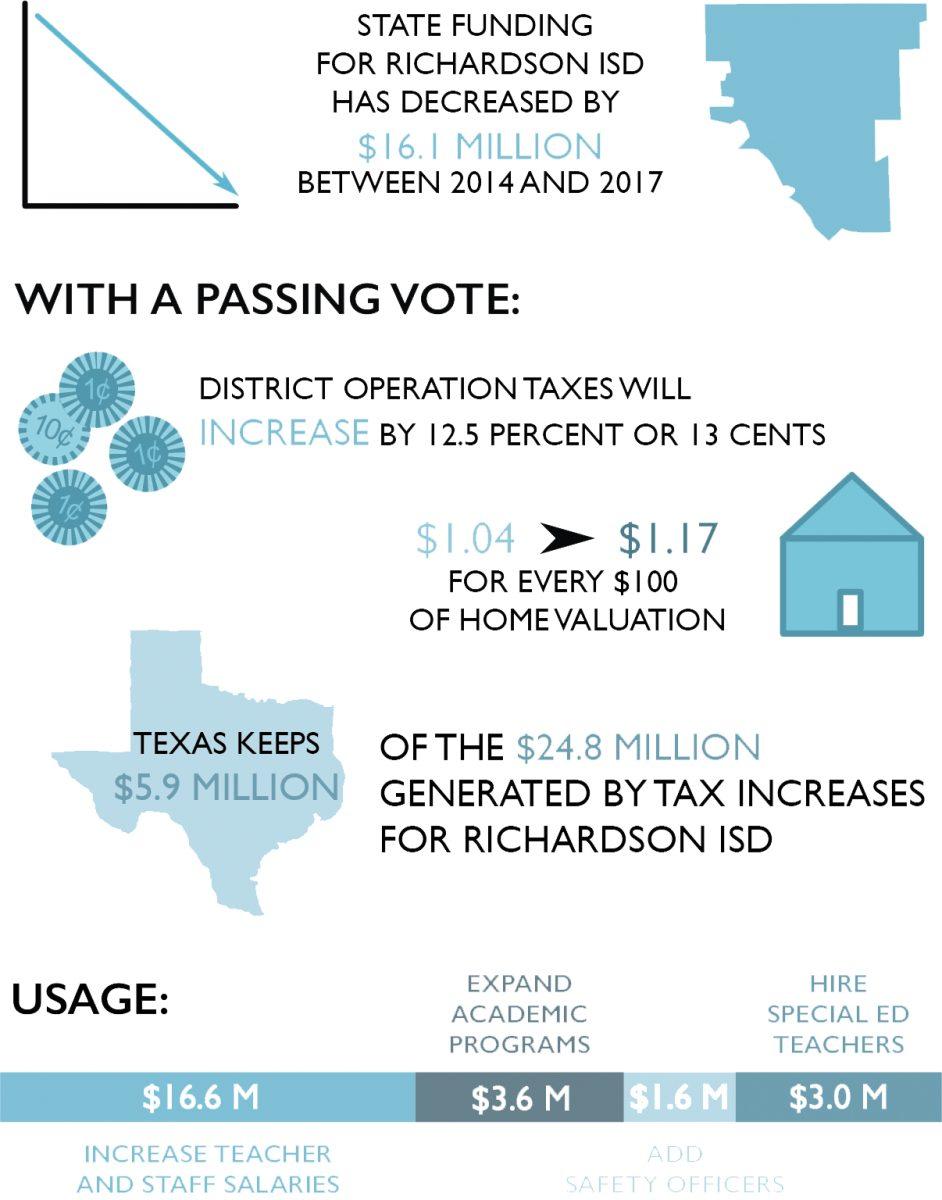

If the vote passes, the district’s operating tax rate will increase by 13 cents, or 12.5 percent, from $1.04 to $1.17 for every $100 of home valuation. For a home with the value of $288,794, the increased tax will be $305 a year. Chief Communications Officer for Richardson ISD Chris Moore said this is the highest possible operating tax rate in the state of Texas. Off-campus apartments in Richardson will also be affected by the tax increase.

“Whatever the apartment owners pay, that would be part of that capture tax base,” Moore said.

Terry Pankratz, vice president for budget and finance at UTD, said residents of University Village and Canyon Creek Heights will not be affected by the tax, as the university is a state entity.

Moore said the funds are intended to be used to increase teacher and staff salaries by 2.5 percent, as well as to increase the amount of teaching and staff positions for students with special needs. But, he said, not all the money will stay in Richardson ISD.

“While $1.17 will generate $24.8 million for us, the state of Texas will actually keep $5.9 million,” Moore said. “When I write that check to RISD, it’s coming to the district, and then it goes to Austin by nature of the system.”

The money generated will be split into a $16.6 million allocation to increase teachers’ and staff salaries, $3.6 million to expand academic programs, $3 million to add special education teachers and $1.6 million to add safety and security officers.

“The 2.5 percent raise is not factored into the budget, but that amount is known and would be able to factor in if the (tax ratification election) passes,” Moore said.

Two political action committees, Vote No RISD TRE and Vote Yes 4 RISD, have become involved in the election. Richardson ISD distributed information packets by mail and held information sessions across the city.

Euan Blackman, a 2006 UTD graduate, is a Richardson resident and a high school teacher at another independent school district. Blackman is also a member of the Vote No RISD TRE political action committee and helps run the Vote No RISD TRE Facebook page. Blackman said he is not opposed to increasing taxes but believes a 13 cents raise is too high.

“I don’t think we need 13 cents… we could have done well at $1.07,” Blackman said.

Blackman said he does not believe the 2.5 percent raise for teachers should be contingent on the passing of the tax ratification.

“(Richardson ISD) got a 6.5 percent raise in revenue this next year,” Blackman said. “They’re holding the teacher raise hostage to (the passage of the tax ratification).”

Richardson resident Sandy Hanne said the potential increase in taxes owed from this tax ratification election will cause her financial strain.

“It is a hardship for me,” she said. “My mortgage went up from $899 to $1,100 and that’s before my next tax increase hits and before this.”

Eric Eager, the co-chair of the Vote Yes 4 RISD political action committee and father of two Richardson ISD students, said the tax ratification election is designed to offset lower state funding.

“What I didn’t know was that as the local property taxes go up, the funding from the state inversely goes down,” Eager said.

Richardson ISD’s tax ratification election handouts reported that state funding had decreased by $16.1 million from 2014 to 2017.

Moore said the tax ratification election is a temporary fix and funding will need to be increased again over the next five years. Voting for the tax ratification election will be held at all early voting locations in Dallas County and on Election Day.